Possible Recession Signs: Examining the Economic Landscape

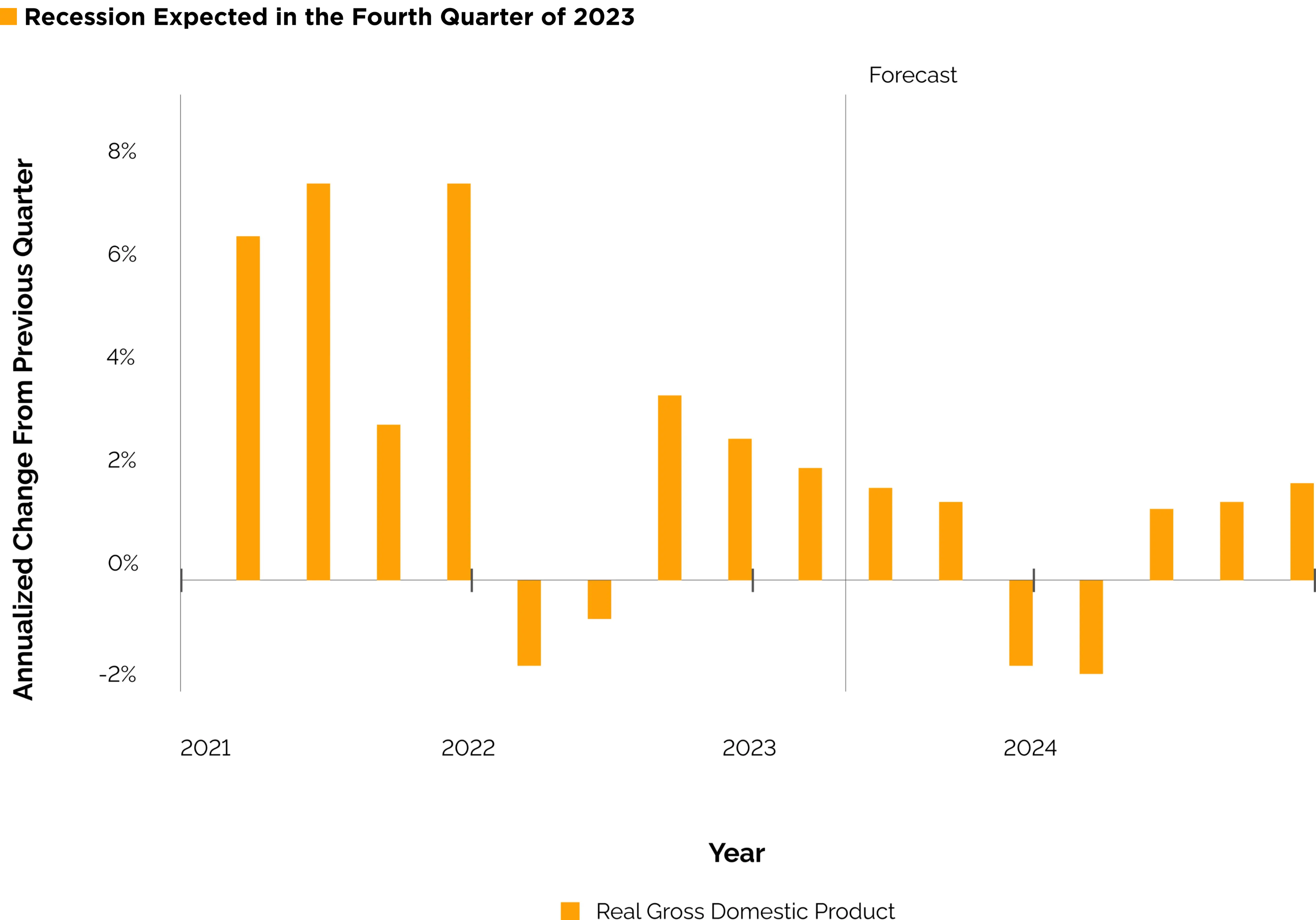

As the economy continues to navigate its way through various challenges, economists have been closely monitoring the possibility of a recession. Initially concerned with the Federal Reserve's interest rate hikes, some experts now express cautious optimism about the nation's economic expansion, albeit at a slow pace. While inflation appears to be subsiding, the potential impact of efforts to tame it remains uncertain. This article will delve into the signs that could indicate the onset of a recession, exploring key areas such as consumer spending, consumer sentiment, housing market conditions, and the commercial real estate sector.

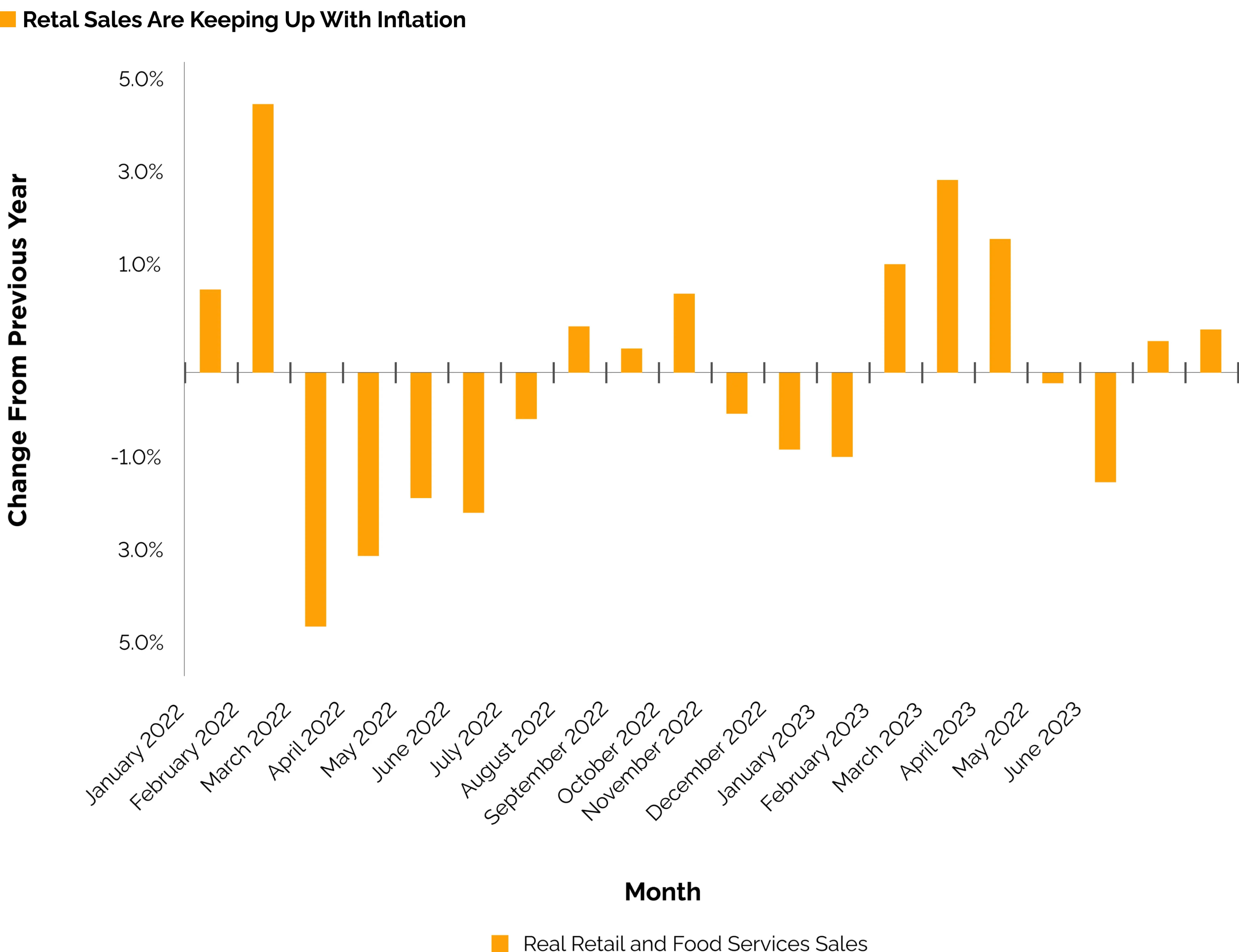

Consumer Spending and Inflation Management:

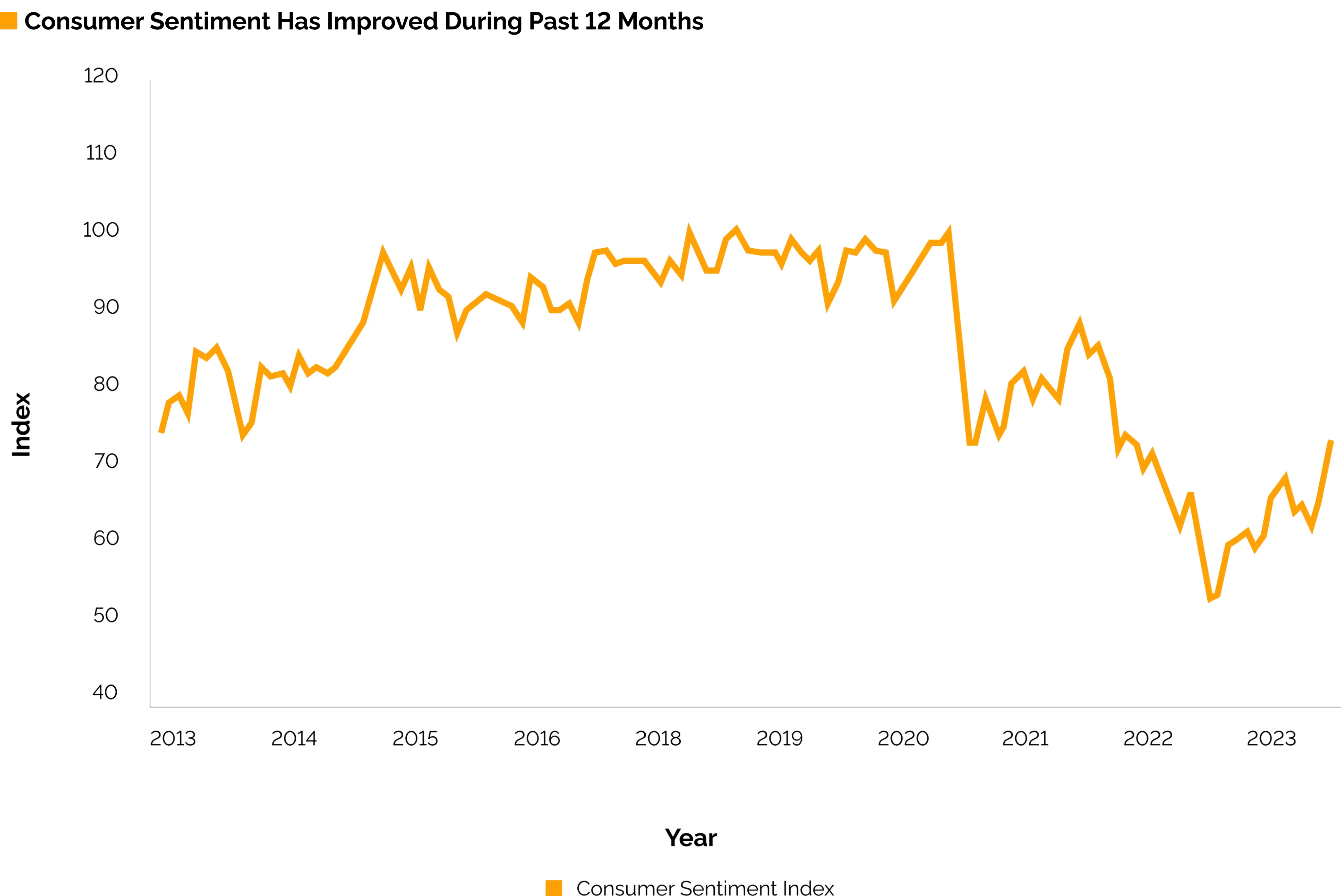

Consumer spending remains at the forefront of the economy, with households managing the effects of inflation and higher interest rates. Surprisingly, the consumer has displayed resilience, as retail and food services sales managed to grow despite a rise in inflation over the past three years. The University of Michigan Consumer Sentiment Survey reflects optimism about the economy's future path, although consumers may face challenges ahead due to skyrocketing debt costs. Credit card interest rates have surged, and for borrowers with federal student debt, interest accrual and repayments will resume soon. The combination of higher credit costs and loan repayments may potentially curb consumer spending and increase the risk of recession.

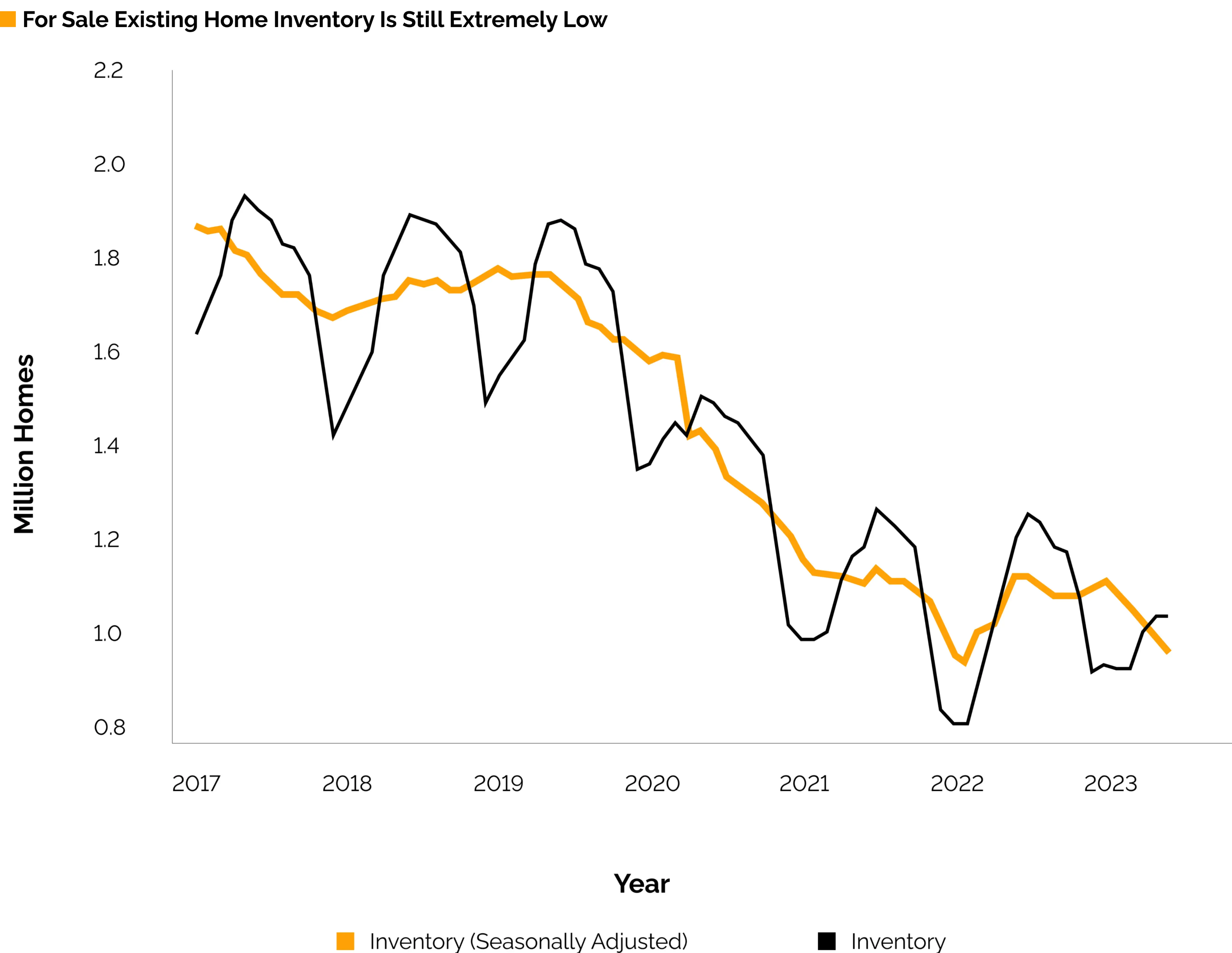

Cooling Housing Market:

The cooling housing market poses another potential threat to the economy. Housing constitutes a substantial portion (over 15%) of the economy, and its slowdown can have significant repercussions. Mortgage rates have climbed to near or above 7%, leaving existing homeowners with low rates secured during the pandemic. This erodes affordability for prospective buyers unable to qualify for home loans at higher rates. Existing home sales have declined, and inventory shortages persist, indicating a prolonged slowdown in home sales.

Troubles in Commercial Real Estate:

The commercial real estate market also faces challenges, with the office sector struggling due to lower workplace utilization rates, and the industrial market experiencing resistance with a decline in construction starts. Additionally, the rapid rise in interest rates has impacted debt, as billions of dollars in loans are scheduled to mature this year and the next. The consequences of these developments may have far-reaching effects across property types, potentially amplifying the risk of a recession.

The Role of the Federal Reserve:

The potential recession, if it materializes, may be driven by tightening financial conditions as the Federal Reserve continues raising its policy rate. This would lead to higher borrowing costs, increased costs of capital, and changes in credit conditions compared to pre-2022 levels. Consumers, businesses, builders, home buyers, and lenders would all be affected by these changes.

As the economy progresses, the possibility of a recession remains a topic of concern for economists and policymakers. While some signs point to continued growth and resilience, others highlight potential areas of vulnerability. Consumer spending, sentiment, the housing market, and the commercial real estate sector are all critical factors that could shape the trajectory of the economy. As the Federal Reserve and policymakers navigate these challenges, their actions and decisions will play a pivotal role in determining the economy's path and the likelihood of a recession in the near future. Monitoring data, such as the personal consumption expenditures price index and personal income, will offer valuable insights into the economy's health and stability.