The Impact of the NAR Lawsuit on the Mortgage and Real Estate Industries

Major Lawsuit Against National Association of Realtors Progresses as Class Action

South Florida's Most Affordable Housing: Rentals

Possible Recession Signs: Examining the Economic Landscape

Inflation Moderation Nears, Federal Reserve Advances

September 2022: South Florida Real Estate Stats

Real Estate Market Forecast in South Florida for 2023

Miami Real Estate Snapshot - August 2023

Vera Fund: 2022 Results and 2023 Strategy

How to become an accredited investor

July 2022: South Florida Real Estate Stats

Advantages of the South Florida Real Estate Rental Market

How to start investing with Vera Fund

August 2022: South Florida Real Estate Stats

Vera Fund's Cryptocurrency Real Estate Investments

The collapse of the banking sector in the USA

Promising investment directions of Vera Fund

Greenberg Traurig Renews Miami Lease

Time To Use A Florida 1031 Exchange

Why does a foreigner buy real estate in Florida?

December 2022: South Florida Real Estate Stats

Key Criteria for South Florida Commercial Real Estate Investment

November 2022: South Florida Real Estate Stats

Oct. 3, 2023

Inflation Moderation Nears, Federal Reserve Advances

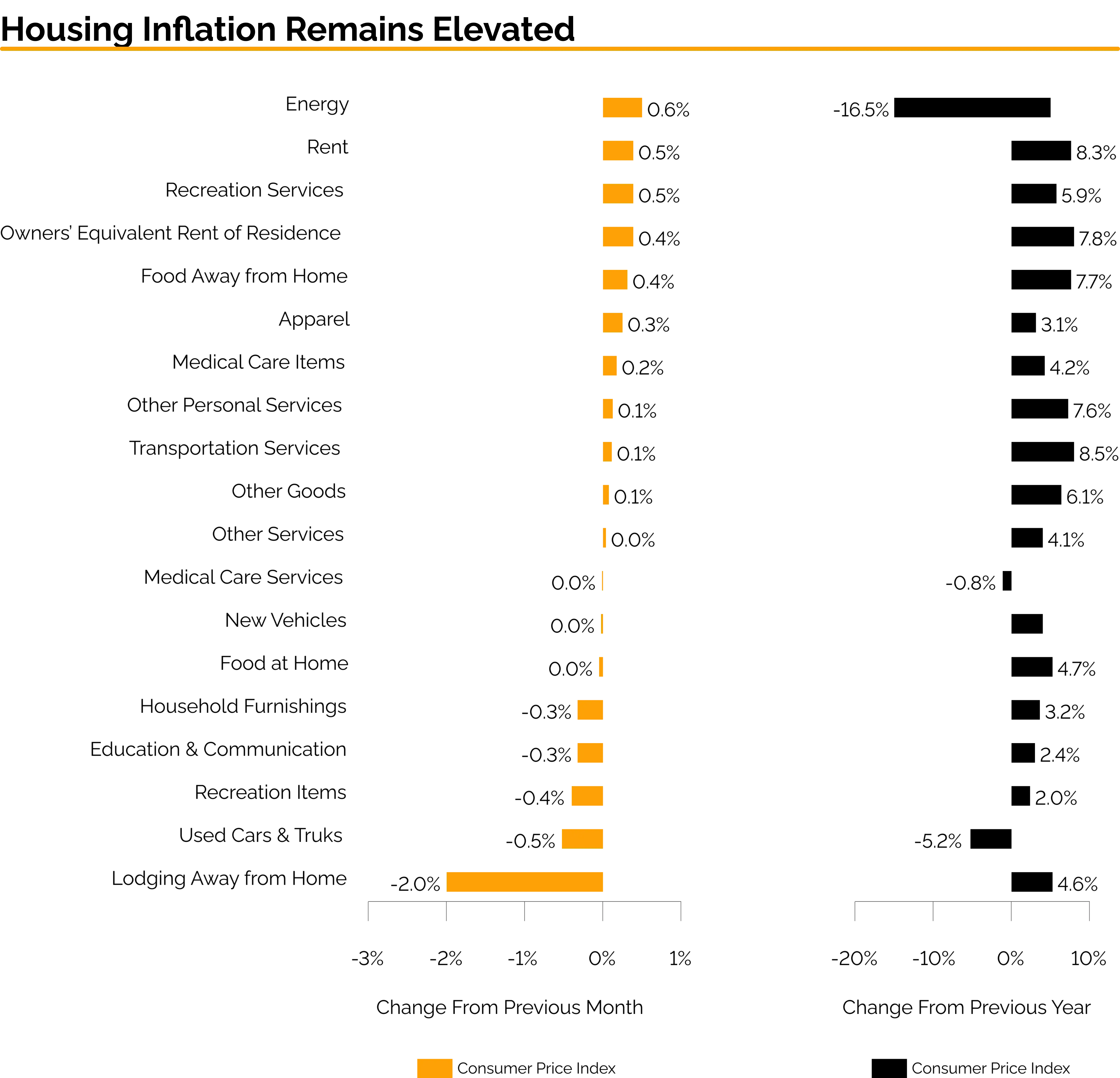

The Federal Reserve is inching closer to its desired outcome as inflation in the United States continues to show signs of moderation. According to the latest data released by the Bureau of Labor Statistics, consumer prices rose by a modest 0.2% in June, a positive indication of the ongoing trend.

One significant factor contributing to the moderation is the core price index, which excludes the volatile food and energy categories. This index, which had stubbornly remained above 0.4% for an extended period, saw a considerable drop to just 0.2% in the past month.

When comparing prices to a year ago, the consumer price index registered a 3% increase, while the core price index rose by 4.8%. Both indicators are getting closer to the Federal Reserve’s targeted rate of 2%, which is an encouraging sign for policymakers

The slowdown in inflation observed in June was evident across various sectors. For instance, travel costs, which had experienced substantial growth as pandemic effects waned, saw a decline of 2% from the prior month. Similarly, airfares and car rental costs increased by only 0.1%, demonstrating a cooling in these segments.

Grocery store prices remained flat over the month, but they were 4.7% higher than a year ago. In contrast, restaurant prices, which are more sensitive to labor costs, rose by 0.4%, marking a strong 7.7% increase from the previous year. It is worth noting that these prices do not include tipping, which has become more commonplace in casual restaurant environments and food delivery services.

Another sector that played a crucial role in inflation over the past two years was the automotive industry. Inventory shortages disrupted production and drove up prices. However, demand has begun to stabilize, leading to flat prices for new vehicles in June and a 0.5% decrease in prices for used cars and trucks compared to the previous year.

Furthermore, signs of cooling inflation can be observed in shelter costs, which account for over a third of overall inflation. In June, shelter costs rose by 0.4%, making up more than 70% of the increase in the all-items index for that month. Owners' equivalent rent, a measure of how much a property owner would pay in rent for their home, rose by 0.4% over the month. Actual rents, on the other hand, saw a 0.5% increase, contributing to 7% of the overall index rise.

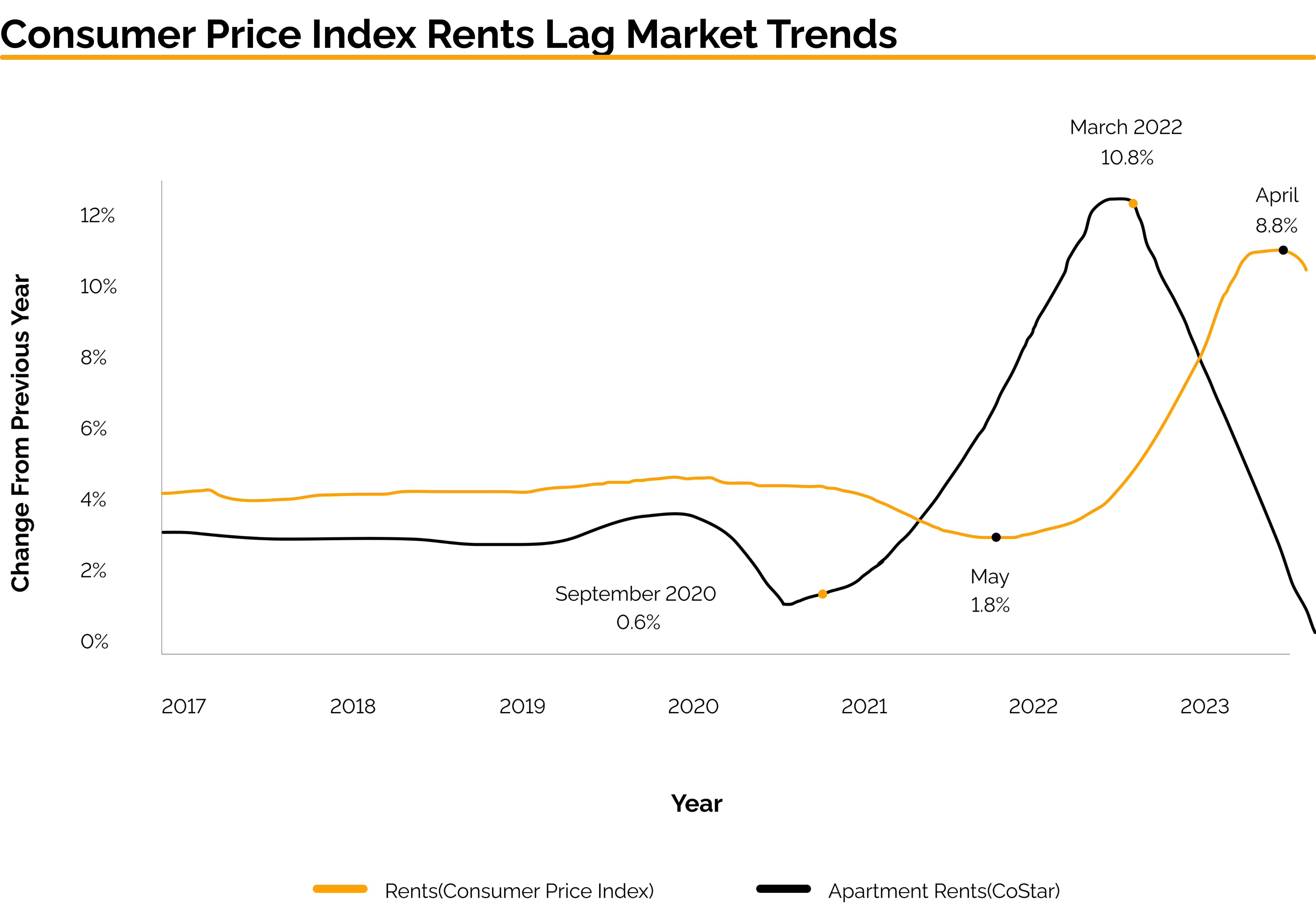

Interestingly, there seems to be a disconnect between shelter costs reflected in the consumer price index and the broader housing market, indicating that deflation in housing might be on the horizon. CoStar data reveals that asking rents for apartments peaked earlier in the year, but the consumer price index lags behind by eight to 12 months due to differences in data collection methodologies. Analysts predict that CPI rent growth will continue to decelerate until mid-2024.

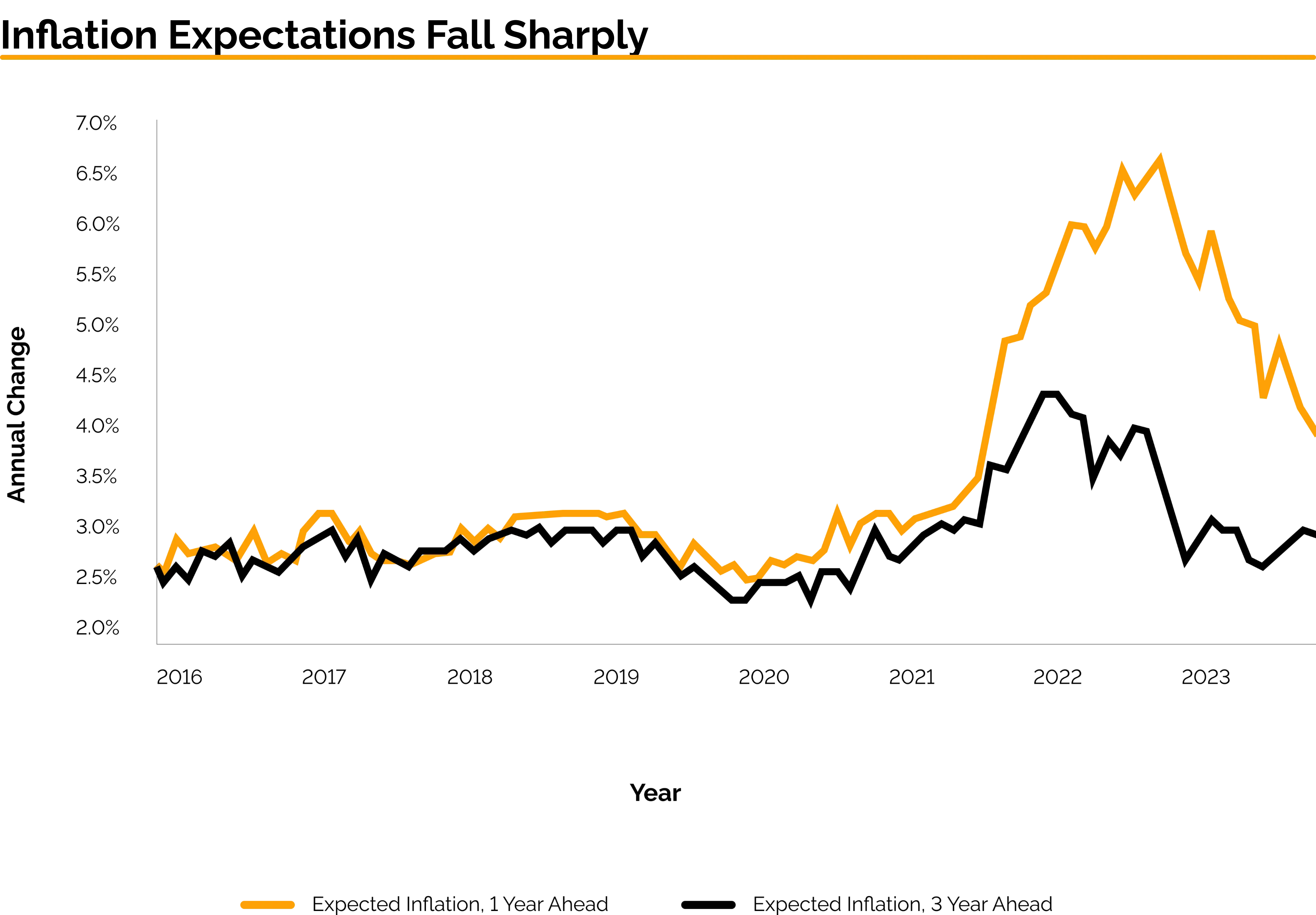

Consumer expectations for inflation have also begun to align with the trend of cooling inflation. According to the Federal Reserve Bank of New York, the median consumer expectation for inflation a year from now has fallen from 6.8% a year ago to 3.8% in June. Additionally, households are more optimistic about longer-term inflation, with their median expectation for inflation three years in the future down to 2.9%. This level is below 3% and reflects a return to pre-pandemic range, which is a positive development.

The supply-side of the economy also points to continued inflation cooling. Wholesale prices, as measured by the producer price index for final demand, grew by a mere 0.1%. However, even further up the production line, prices for processed intermediary goods fell by 0.6% in June, and unprocessed intermediate goods experienced a substantial 2.1% decline.

On the services side, prices for final demand showed a moderate increase of 0.2%, while prices for intermediate demand of services remained flat in June. These prices are closely tied to labor costs, which have started to outpace inflation.

In conclusion, the Federal Reserve's efforts to achieve its inflation target are showing promising results, as inflation continues to moderate. The recent data indicates a broad-based slowdown in various sectors, suggesting a positive outlook for the economy. As consumer and business confidence remain stable, the overall economic conditions appear favorable. However, policymakers and analysts will continue to closely monitor the evolving situation to ensure sustainable growth and stability in the long term.