The Impact of the NAR Lawsuit on the Mortgage and Real Estate Industries

Major Lawsuit Against National Association of Realtors Progresses as Class Action

South Florida's Most Affordable Housing: Rentals

Possible Recession Signs: Examining the Economic Landscape

Inflation Moderation Nears, Federal Reserve Advances

September 2022: South Florida Real Estate Stats

Real Estate Market Forecast in South Florida for 2023

Miami Real Estate Snapshot - August 2023

Vera Fund: 2022 Results and 2023 Strategy

How to become an accredited investor

July 2022: South Florida Real Estate Stats

Advantages of the South Florida Real Estate Rental Market

How to start investing with Vera Fund

August 2022: South Florida Real Estate Stats

Vera Fund's Cryptocurrency Real Estate Investments

The collapse of the banking sector in the USA

Promising investment directions of Vera Fund

Greenberg Traurig Renews Miami Lease

Time To Use A Florida 1031 Exchange

Why does a foreigner buy real estate in Florida?

December 2022: South Florida Real Estate Stats

Key Criteria for South Florida Commercial Real Estate Investment

November 2022: South Florida Real Estate Stats

May 1, 2022

December 2022: South Florida Real Estate Stats

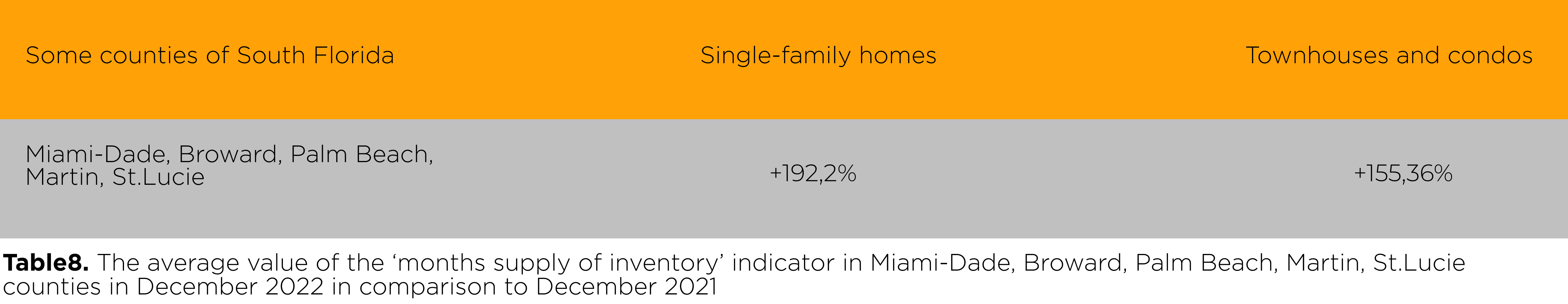

Nick Polyuskin's traditional five-county South Florida residential real estate market overview (Miami-Dade, Broward, Palm Beach, Martin, St. Lucie) focuses segments such as single-family homes, condominiums and townhomes.

Nick Polyuskin, an expert, licensed broker and head of Vera Realty, talks about real estate market news from Miami Association of Realtors reports for December 2022 compared to December 2021.

The information is based on an analysis of the Federal Reserve Bank Research Department database (https://fredhelp.stlouisfed.org/fred/) regarding the Federal Reserve's (Fed) key interest rate and the associated most popular mortgage loan in the United States.

Housing market in South Florida in December 2022

Nick Polyushkin estimates the South Florida real estate market in December 2022:

We have access to analytical data from which we examine South Florida real estate market data in the current moment and make preliminary forecasts for the near future.

In this review, we examine changes in the dynamics of eight key indicators that characterize the real estate market in December 2022, which is the end of 2022 And previously consider the emerging trends at the beginning of 2023

The "closed sales" rate for Miami-Dade County (South Florida) single-family homes dropped to 45.1%, showing a significant drop in sales. In December virtually no one is moving, people are trying to wrap things up and not start new business, much less buy real estate. The real estate market in December, as has historically been the case, is always characterized by a slowdown in activity. In December 2022, 75% of buyers across this county were making their purchases of single -family homes on credit, which may indicate that they have adjusted to the current interest rate.

In January 2023, we see a slight decrease in the rate, affecting an immediate increase in market activity.

Using Miami-Dade County as an example, we can see that real estate prices have barely changed, while the size of transactions has dropped significantly, indicating that people have started buying properties in the cheaper segment.

In December 2022 in Miami-Dade County, data such as "% of the price received from the original list" indicates that bargaining took place, about 5%.

For single-family homes the values of such indicators as "median time to contract" ,"median time to sales", “inventory/ active lists”, “month supply of inventory” are increasing. Of course, the inventory has not yet reached the number that indicates an active market.

In the "townhouses and condominiums" segment the same changes are taking place.

In general, in all the counties we have considered, there is an increase in the supply of inventory, there is an opportunity to bargain with real estate dealers and get a discount on the purchase of real estate, the terms of contracts are increasing, and all these changes indicate that the market is slowly returning to the pre-pandemic state, when financing rates for purchases were at the level of 5-6%.

In December 2022, when news broke that the recession was slowing down, and the financing rates for the purchase of a house began to fall from 6.8% to 6%. The Federal Reserve Center said that if the rate is raised in the near future, it will be minimal. According to this news, banks issue loans for short periods with a change in the rate. You can always find a property that satisfies certain interests.

Vera Realty has a lot of houses and interesting projects. Contact us, and we will help you find the required objects.

Statistics indicators of the residential real estate market in South Florida

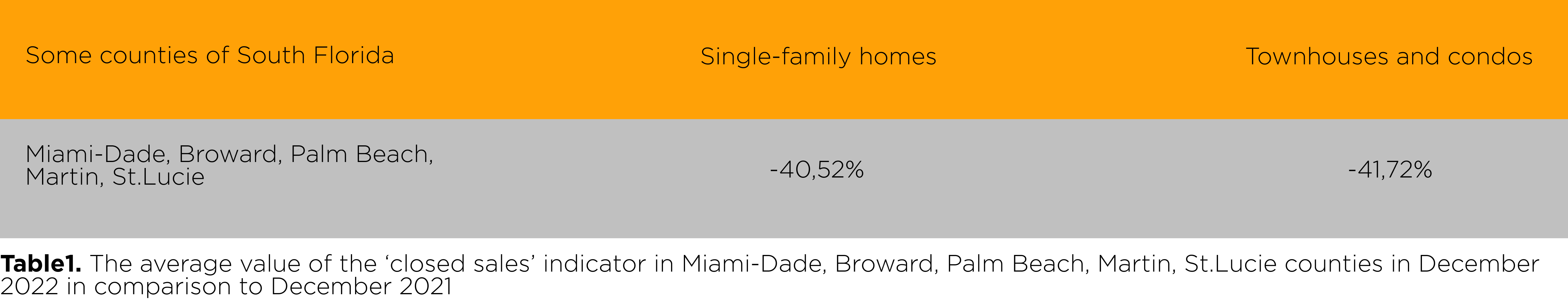

- Closed sales

Compared to December 2021, single-family home sales in Miami-Dade County in December 2022 were down -45.1% year over year (November 2022: -38.5%). Sales of existing townhomes and condominiums were down -50% year-over-year (November, 2022: -42.1%).

In Broward County, December 2022 single-family home sales were down -43.2% year-over-year (November 2022: -35.9%). Townhouse and condominium sales in Broward were down -37.9% year over year (November, 2022: -34.3%).

Palm Beach single-family home sales declined to -37.6% in December 2022 (November, 2022: -38.3%) and Palm Beach townhouse and condominium sales declined by -43.1% (November, 2022: -44.2%).

Sales of single-family homes in Martin fell to -37.6% in December 2022 (November, 2022: -45.4%). Compared to homes, sales of townhomes and condominiums in Martin are down only -38.9% (November, 2022: -26.3%).

Compared to December 2021 in St. Lucie, the rate for single-family homes dropped to -39.1% year-over-year (November, 2022: -33.8%); and for townhouses and condominiums, it changed to -38.7% (November, 2022: -39.7%).

In December 2022, five South Florida counties saw a decline in closed sales of single-family homes to -40.52% and townhouses and condominiums to -41.72% (compared to December 2021). The downward trend in sales of single-family homes and townhomes and condominiums that began in October 2022 continues into December 2022 This decline is due to inventory shortages and rising mortgage rates.

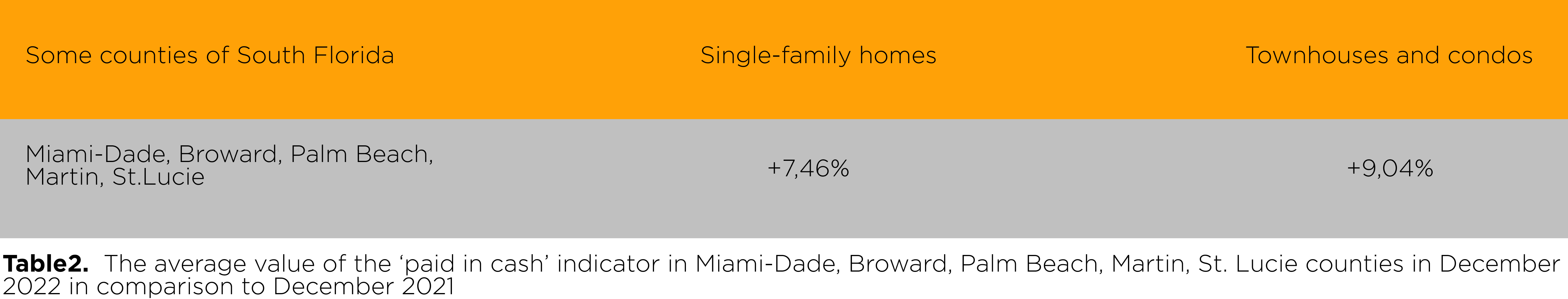

- Paid in cash

Comparing December 2022 cash sales in Miami-Dade to the prior year period, there is a -5.6% decrease for the single-family segment (November, 2022: -0.5%), and a +10% increase for townhouses and condos (November, 2022:+13.1%).

Cash sales in Broward in December 2022 showed an increase for single-family homes of +12.4% (November, 2022: +16.7%) and for townhouses and condos of +4.3% (November, 2022: 0%).

Palm Beach County saw a slight increase in December 2022 single-family home sales of +12.3% (November, 2022: +7.9%) and a marked decrease in townhouse and condominium sales of -5% (November, 2022: +5.6%).

In Martin County, December 2022 sales of single-family homes for cash jumped to +19.7% (November, 2022: +0.8%), and sales of townhouses and condominiums were up significantly by +30% (November, 2022: -19.9%).

In St. Lucie, the change in cash payments for single-family homes ranged from +17.2% (November, 2022) to -1.5% (December, 2022), and for townhouses and condominiums from +14.1% (November, 2022) to +5.9% (December, 2022).

Overall, the December 2022 "cash payment" rate for the five counties under consideration compared to December 2021 is as follows: for "single family homes" it changed from +8.42% (November, 2022) to +7.46% (December, 2022), and for "townhouses and condos" it ‘dropped’ from +10.54% (November, 2022) to +9.04% (December, 2022).

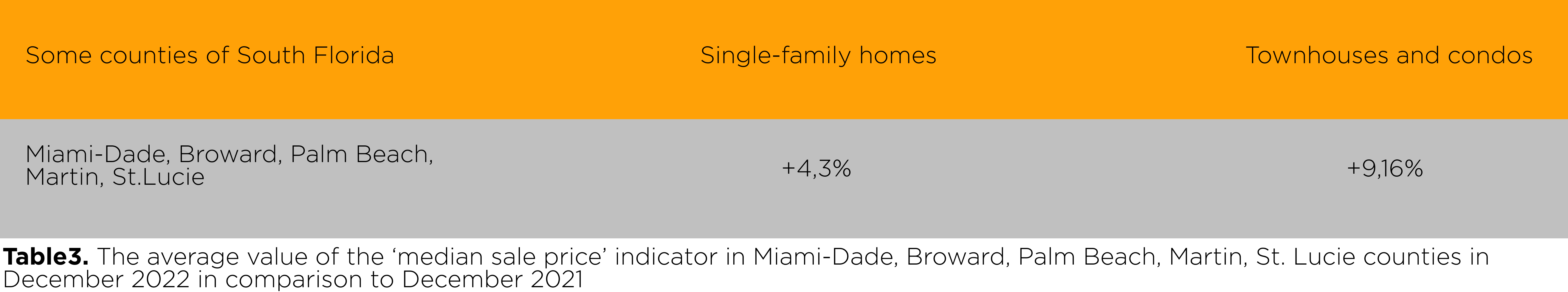

- Median sale price

In Miami-Dade County, the median sales price of single-family homes increased to +1.1% over the previous December 2021, and for townhouses and condominiums it also increased to +5.5%.

In Broward County, the median sales price for single-family homes rose to +6.0%, and for townhouses and condominiums it changed from +9.7% to +8.1% from the previous month (November 2022).

In Palm Beach County, median single-family home prices were +3.81% (November, 2022: +10.78%) and townhouse and condo prices changed to +14.0% (November, 2022:+10.8%).

In Martin County, single-family home prices fell to -3.4% (November, 2022: -4.0%) and townhouse and condo prices changed significantly to -1.8% (November, 2022: +42.1%).

In St. Lucie, the rate for single-family homes rose to +14.0% (November, 2022: +16.1%) and for townhouses and condos changed to +20.0% (November, 2022: +23.1%).

In December 2022, in 5 South Florida counties, the average median sales price for single-family homes "fell" from +8.7% (November, 2022) to +4.3% (December, 2022), and for townhouses and condominiums the figure also “declined” from +20.06% (November, 2022) to +9.16% (December, 2022).

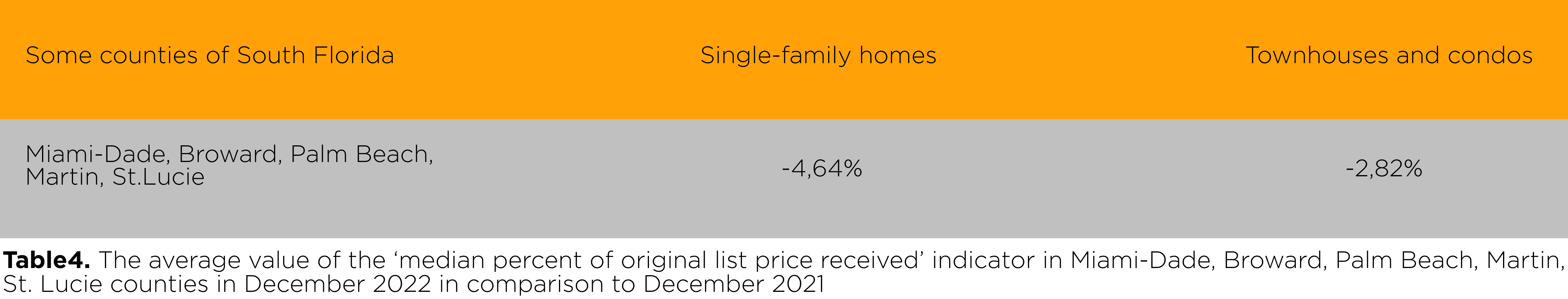

- Median percent of original list price received

In December 2022, the "median percentage of original price" for single-family homes in all five counties was -4.64% compared to last year, and -2.82% for townhouses and condominiums. As for comparisons to November 2022, the figure was virtually unchanged.

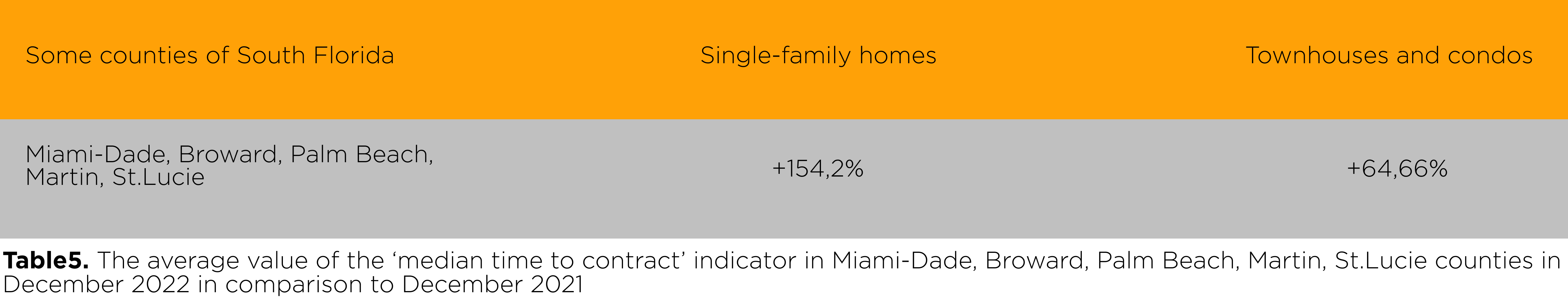

- Median time to contract

In Miami-Dade County, for the segment 'single-family homes' the indicator ‘median time to contract’ was +84.2% year-over-year, and for ‘townhouses and condominiums’, it was down -5.6%.

In Broward County, the index for single-family homes increased by +113.3% year- over-year, and for townhouses and condominiums it reached +9,1%.

In Palm Beach County, the median time to make a contract for the purchase of single-family homes was up to +157.14%, and for townhouses and condominiums +92.9%.

In Martin County, the change in the indicator for single-family homes was +150.0%, and for townhouses and condominiums the indicator also rose significantly to +150,0%.

In St. Lucie, the skyrocket increase in the median time of the contract for single-family homes was +270.0%, and for townhouses and condominiums, this parameter went down to +76.9%.

In December 2022, there was an increase in the "median contract time" for single-family homes to +154.2% in almost all five counties compared to December 2021 For townhouses and condominiums, the value of the indicator was +64.66%.

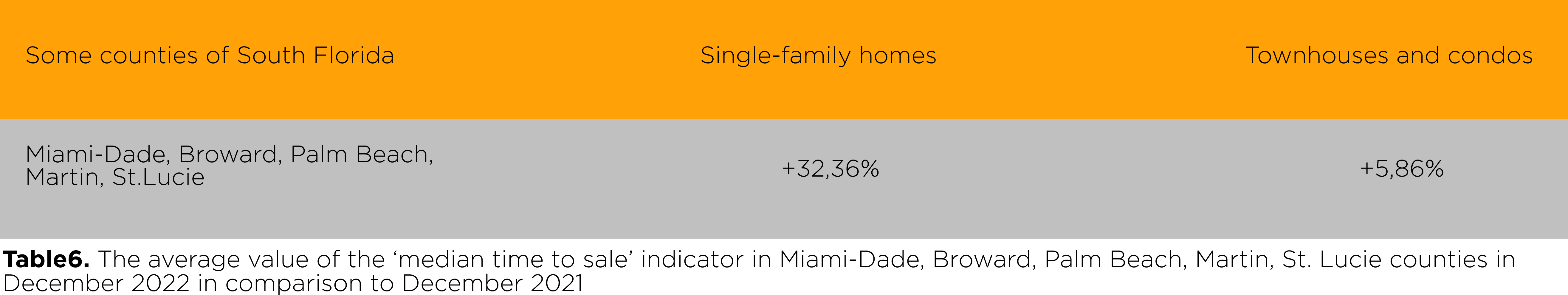

- Median time to sale

In December 2022, the "median sales time" for single-family homes changed from +30.11% (November, 2022) to +32.36%, compared to December 2021, and from +16.28% (November, 2022) to +5.28% (December, 2022) for townhouses and condos in the five counties considered.

The shortest time to complete sales was in St. Lucie County, where it was 54 days for townhouses and condominiums in December 2022 In the same county, the longest sales completion time for single-family homes was 88 days. In December 2022, real estate transactions took between 54 and 88 days, depending on property types and the neighborhood itself.

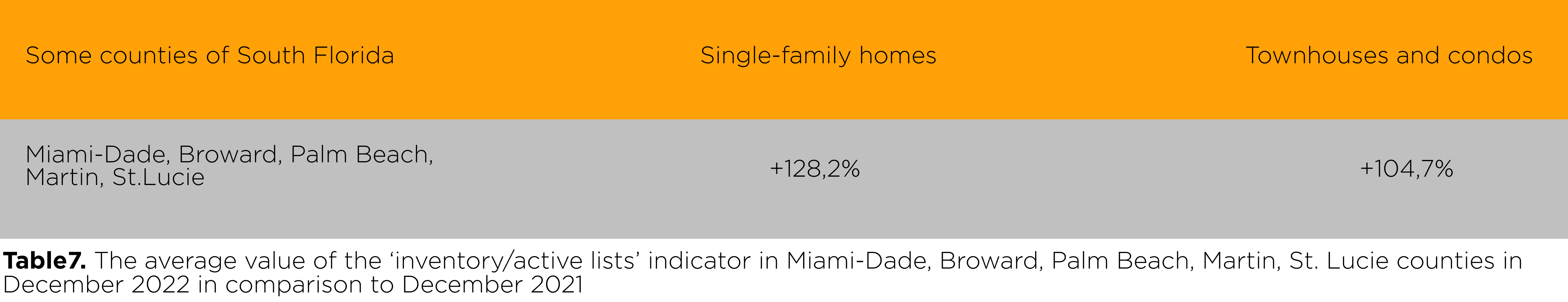

- Inventory/active lists

In Miami-Dade County, the number of single-family homes increased +57.7% in December 2022, and the number of condos changed +3.6% from the same period in 2021, but increased from November 2022

In Broward County, the inventory rate for single-family homes increased from +88% (November 2022) to +106.9% (December 2022) and for townhouses and condominiums from +24.4% (November 2022) to +39.2% (December 2022).

In Palm Beach County, the active inventory index for single-family homes changed from +133.22% (November, 2022) to +120.63% (December, 2022), and the index for townhouses and condos increased from +80.6% (November, 2022) to +98.5% (December, 2022).

In Martin County, the increase for single-family homes was from +125.1% (November, 2022) to +185.1% (December, 2022), and for townhouses and condominiums it soared from +89.4% (November, 2022) to +282.9% (December, 2022).

In St. Lucie, the increase for single-family homes was from +159.1% (November, 2022) to +170.7% (December, 2022), and the positive trend for townhouses and condominiums was a change from +81.1% (November, 2022) to +99.3% (December, 2022).

The December increase in active listings across the five counties was +128.2% compared to December 2021, and for townhouses and condominiums the change was +104.7%.

- Months supply of inventory

In December 2022, monthly inventory supply continued to increase slowly to 4 months and up.

In Miami-Dade, monthly supply in the single-family market increased to +100% (4 months) over last year. The supply of existing condos increased to +24.2% (4.1 months).

In Broward County, monthly inventory for single-family homes increased to +172.7% (3 months) and for townhomes and condominiums the figure was +64.7% (2.8 months).

In Palm Beach County, the monthly inventory supply rate for single-family homes continued to rise from +175% (November 2022) to +190.9% (3.2 months), and for townhouses and condominiums it changed from +133.3% (November 2022) to +158.3% (3.1 months) in December 2022

In Martin County, the rate for single-family homes was +287.5% (3.1 months) and for townhouses and condominiums continued to rise to +357.1% (3.2 months).

In St. Lucie County, inventory supply for single-family homes changed from +166.7% (November, 2022) to +210% (3.1 months) in December 2022; and for townhouses and condominiums, the change was from +158.3% (November, 2022) to +172.7% (3.0 months) in December 2022

As of December 2022, the median price of a single-family home in Florida was $395,000, up 6% from last year. The median price of townhomes and condominiums in Florida was $310,000.

With the limited amount of housing inventory currently available, adequately priced homes continue to sell fairly quickly after hitting the market, and homes in good neighborhoods with good schools and preferred locations still meet with numerous offers, but at a much slower pace than during the market peak.

If you want to calculate the cost of a mortgage, we invite you to use the mortgage calculator on the Vera Realty Website.