The Impact of the NAR Lawsuit on the Mortgage and Real Estate Industries

Major Lawsuit Against National Association of Realtors Progresses as Class Action

South Florida's Most Affordable Housing: Rentals

Possible Recession Signs: Examining the Economic Landscape

Inflation Moderation Nears, Federal Reserve Advances

September 2022: South Florida Real Estate Stats

Real Estate Market Forecast in South Florida for 2023

Miami Real Estate Snapshot - August 2023

Vera Fund: 2022 Results and 2023 Strategy

How to become an accredited investor

July 2022: South Florida Real Estate Stats

Advantages of the South Florida Real Estate Rental Market

How to start investing with Vera Fund

August 2022: South Florida Real Estate Stats

Vera Fund's Cryptocurrency Real Estate Investments

The collapse of the banking sector in the USA

Promising investment directions of Vera Fund

Greenberg Traurig Renews Miami Lease

Time To Use A Florida 1031 Exchange

Why does a foreigner buy real estate in Florida?

December 2022: South Florida Real Estate Stats

Key Criteria for South Florida Commercial Real Estate Investment

November 2022: South Florida Real Estate Stats

April 9, 2023

Miami Real Estate Snapshot - August 2023

In August 2023, Miami's home prices and household incomes continue to rise due to wealth migration, but there is a growing need for more inventory to meet the high demand in the market. This information was revealed in statistics released by the MIAMI Association of Realtors (MIAMI) and the Multiple Listing Service (MLS) system.

Miami-Dade County saw an increase in pending sales for single-family homes for the second consecutive month, rising from 1,016 to 1,032 transactions year-over-year. Pending sales serve as an indicator of future sales. Additionally, the total showing appointments for South Florida increased for the third consecutive month, experiencing an 8% year-over-year jump, from 208,359 in July 2022 to 224,187 in July 2023.

Despite mortgage rates being at 20-year highs, the Miami real estate market continues to show an increase in pending sales for single-family homes and luxury condo sales. Ines Hegedus Garcia, MIAMI Chairman, attributed this to South Florida's strong market fundamentals, including a high percentage of cash buyers and a rising year-over-year population. However, the lack of inventory, especially new listings, is impacting further growth in this high-demand market.

Comparing current home transactions to the booming 2021-22 era, characterized by historically low mortgage rates of 2.65%, a pandemic-driven remote work expansion, and a housing boom, shows a decline in Miami's total home sales by 13.6% year-over-year in July 2023. The number dropped from a historic 2,375 transactions in July 2022 to 2,051 in July 2023 due to elevated mortgage rates and a shortage of supply in certain price points.

Most homes purchased in July 2023 had their terms set in June when mortgage rates peaked at 6.71%. To provide context, rates were at 5.09% on June 2, 2022. Despite these elevated rates, Miami-Dade single-family pending sales saw a year-over-year increase from 1,016 to 1,032 transactions for the second consecutive month.

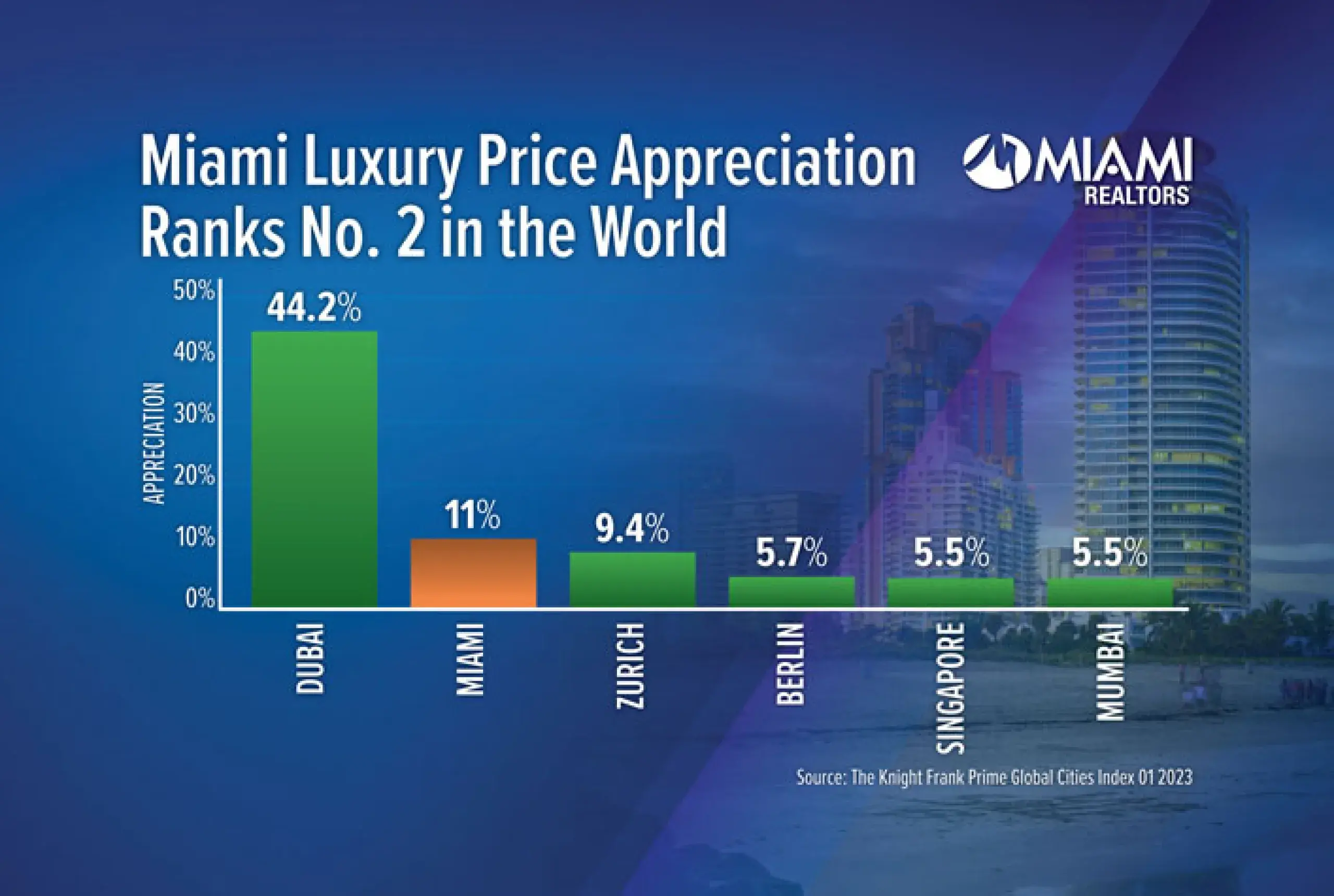

Miami-Dade County's impressive price growth of over 10% is noteworthy, especially in a market with mortgage rates hovering around 7%. This indicates significant pent-up demand that is likely to be unleashed as mortgage rates trend lower in 2024, according to Gay Cororaton, MIAMI REALTORS® Chief Economist. While buyers might be tempted to wait for lower interest rates, it's essential to note that the shortage of homes for sale is unlikely to lead to price reductions. As a result, buyer competition is expected to intensify in 2024 as mortgage rates decline.

In July 2023, Miami single-family home sales decreased by 8.9% year-over-year, from 999 in July 2022 to 910, partly due to comparisons with a historically strong month and the current market's lower inventory in specific price points and higher interest rates. Miami's existing condo sales also decreased by 17.1% year-over-year, falling from a historic 1,376 in July 2022 to 1,141 in July 2023 due to a lack of inventory and rising mortgage rates.

In terms of median prices, Miami-Dade County saw a 10.8% year-over-year increase in July 2023 for single-family homes, rising from $570,000 to $631,670. Miami's single-family median prices have experienced continuous growth for 140 consecutive months, setting a record. Existing condo median prices also increased by 10.5% year-over-year, reaching $420,000 from $380,000. Condo median prices have either remained steady or increased in 140 of the last 146 months.

Miami is ranked as the fourth city in the U.S. for annual home price appreciation, according to the latest US CoreLogic S&P Case-Shiller Index. Historically, a market with less than a 6-month supply of inventory will have appreciating prices. In Miami, single-family homes and existing condos have 3.2 and 5.1 months of supply, respectively.

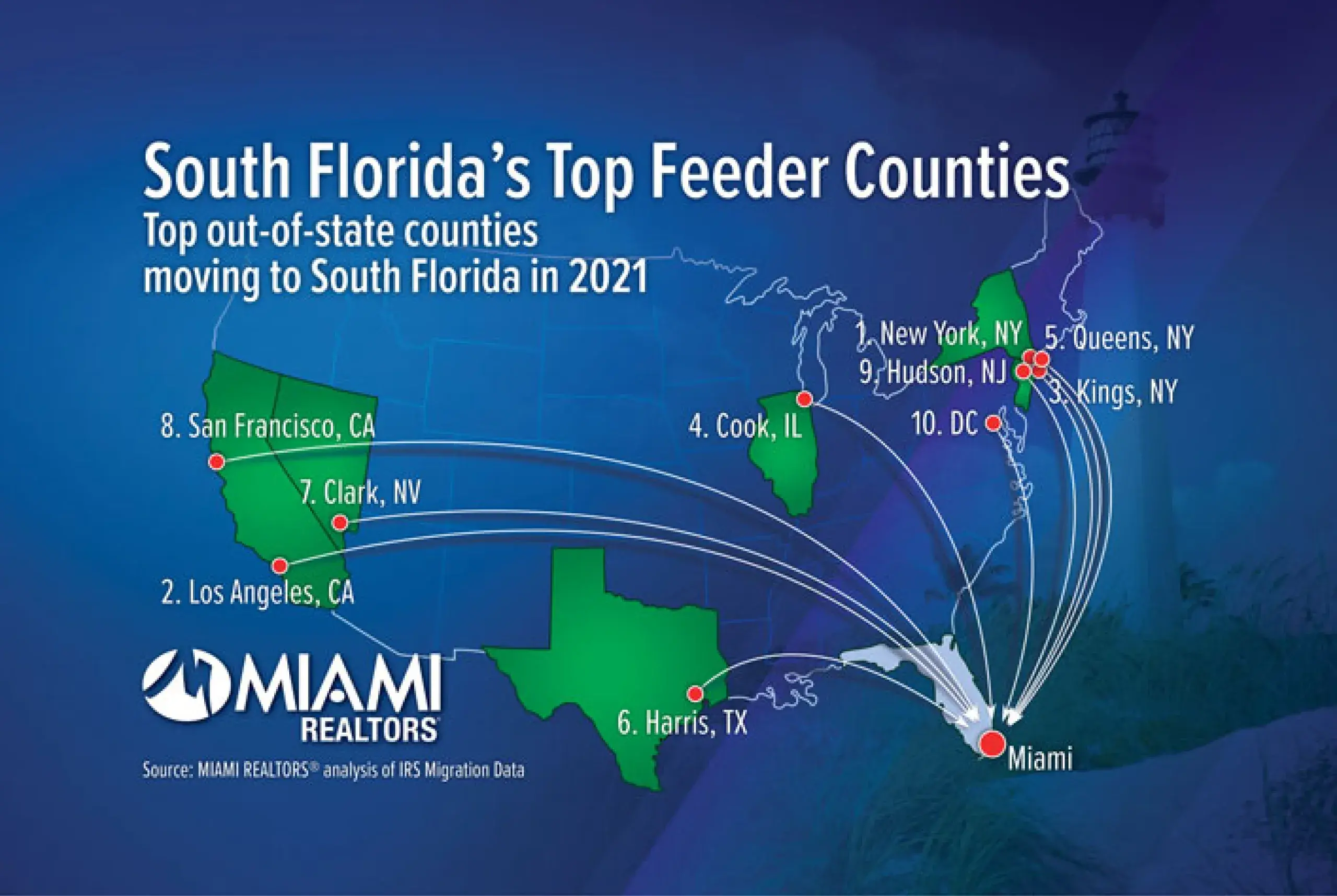

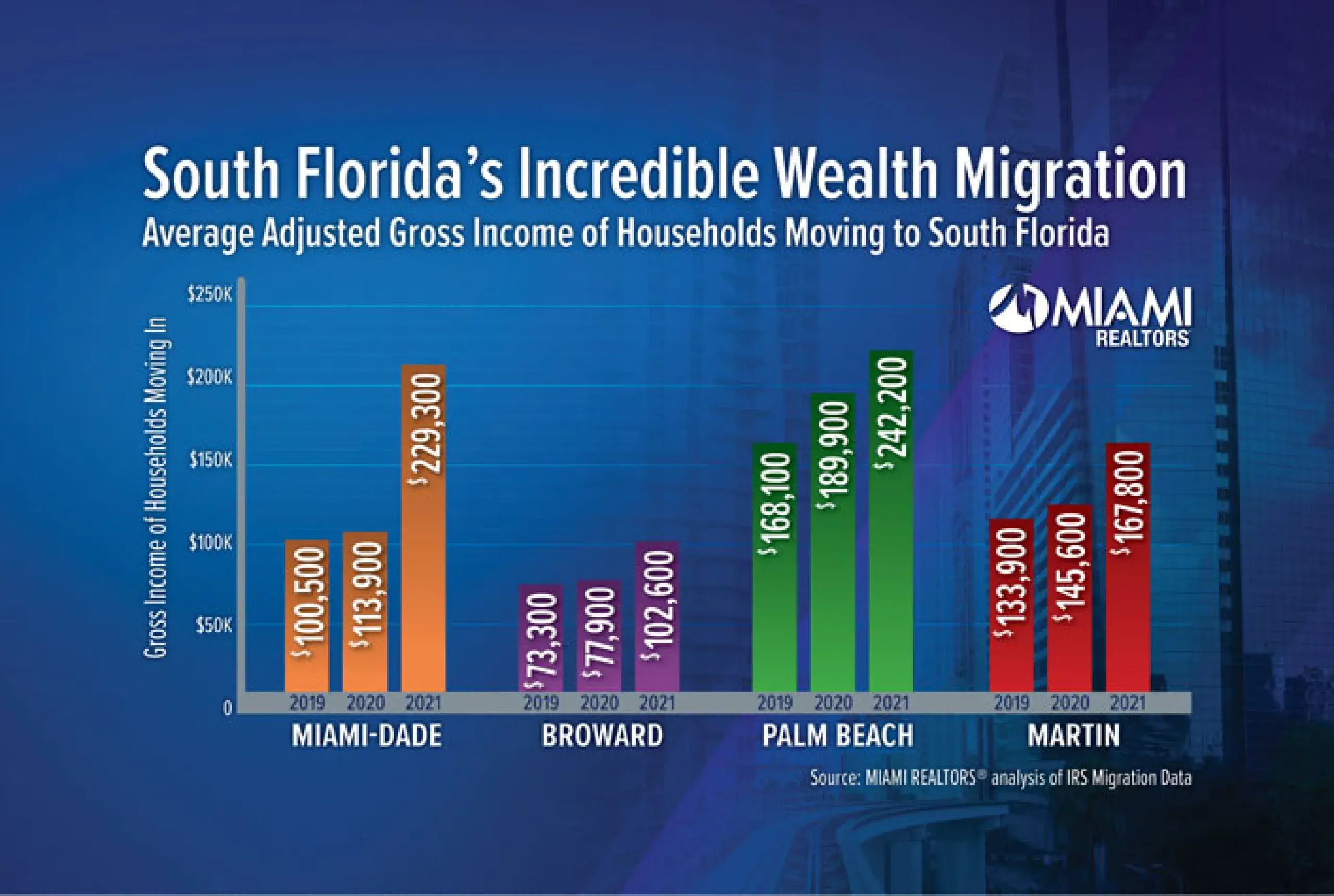

Local home prices have been rising thanks to wealth migration to South Florida. According to MIAMI REALTORS® analysis of migration data released by the Internal Revenue Service for 2020-2021, in-migration has increased South Florida's household income by $16 billion in 2021. New households moving into Miami-Dade in 2021 had an average adjusted gross income of $229,300. In comparison, new households moving into Broward County had an average adjusted gross income of $102,600, while those moving into Palm Beach County had an average adjusted gross income of $242,200.

Miami-Dade County's population increased year-over-year in 2022, according to new U.S. Census Bureau population estimates. This makes Miami-Dade one of only 11 counties in the U.S. to return to positive population growth in 2021-2022 after experiencing pandemic-driven population declines that affected the entire country, as reported by the Brookings Institute.

Inventory remains a significant challenge in Miami's real estate market. The historical average for Miami-Dade inventory is 20,302, but the current inventory stands at 8,964. Total inventory has decreased by 59.1% since the pre-pandemic period (July 2019) when it was at 21,906.

Total active listings at the end of July decreased by 10.1% year-over-year, from 9,973 to 8,964. Inventory for single-family homes decreased by 23.3% year-over-year in July 2023, dropping from 3,727 active listings the previous year to 2,860. Condominium inventory also decreased by 2.3% year-over-year, from 6,104 listings during the same period in 2022 to 6,246.

Miami's real estate market had a substantial local economic impact in July 2023. Each home sale has a ripple effect on the economy, including income generated from real estate industries (commissions, fees, and moving expenses), expenditures related to home purchases (furniture and remodeling expenses), a multiplier effect on housing-related expenditures (income generated from a home sale is reinvested into the economy), and new construction (additional home sales lead to increased home production).

Home sales are notably affected by changes in mortgage rates. As of August 17, the 30-year fixed-rate mortgage averaged 7.09%, up from 6.96% the prior week and significantly higher than the 5.13% rate from one year ago.

According to NAR, the total economic impact of a typical Florida home sale is $122,000. In July 2023, Miami-Dade sold 2,051 homes, resulting in a local economic impact of $250.2 million.

The total dollar volume of Miami's real estate transactions reached $1.59 billion in July 2023. Single-family home dollar volume decreased by 17.6% year-over-year to $846 million, while condo dollar volume decreased by 5.4% year-over-year to $746 million.

Miami's distressed sales remain low, indicating a healthy market. Only 1.3% of all closed residential sales in Miami were distressed in July, including REO (bank-owned properties) and short sales, which is lower than the 1.7% reported in July 2022. In contrast, distressed sales accounted for 70% of Miami sales in 2009. Short sales and REOs represented 0.3% and 0.9%, respectively, of total Miami sales in July 2023. Miami's percentage of distressed sales aligns with the national figure, where distressed sales represented 1% of total sales in July 2023, remaining virtually unchanged from the previous month and the previous year.

When it comes to median price appreciation, Miami is outperforming both the nation and the state of Florida. Statewide in Florida, closed sales of single-family homes totaled 22,198 in July 2023, marking a 6.4% year-over-year decrease, while existing condo-townhouse sales totaled 8,463, reflecting a 9.4% drop. It's important to note that closed sales may occur 30 to 90-plus days after sales contracts are written.

Nationally, total existing-home sales transactions decreased by 2.2% from June, reaching a seasonally adjusted annual rate of 4.07 million in July. Year-over-year, sales slumped by 16.6%, down from 4.88 million in July 2022.

The statewide median sales price for single-family existing homes in Florida was $415,000, marking a 0.7% increase from the previous year, according to data from the Florida Realtors Research Department in partnership with local Realtor boards/associations. For condo-townhouse units, last month's statewide median price was $319,000, representing a 4.6% increase over the year-ago figure. The median price serves as the midpoint, with half of the homes selling for more and half for less.

Nationally, the median price for existing homes of all types in July was $406,700, reflecting a 1.9% increase from July 2022 ($399,000). Prices rose in the Northeast, Midwest, and South but remained unchanged in the West.

In Miami's real estate market, properties continue to attract offers close to the listing price. The median percent of the original list price received for single-family homes in July 2023 was 97.2%, down from 99% the previous year. For existing condominiums, the median percent of the original list price received was 96.4%, also down from 99% the previous year.

The median number of days between listing and contract dates for single-family home sales in Miami was 24 days, up from 17 days the previous year. The median time to sale for single-family homes increased to 68 days, up from 62 days in the previous year.

For condominiums, the median number of days between the listing date and contract date was 32 days, up from 20 days, while the median number of days to sale for condos decreased to 77 days, down from 64 days.

Cash sales represented 39.6% of all closed sales in Miami in July 2023, compared to 41.3% in July 2022. This is higher than the national figure of 26% of U.S. home sales being made in cash, according to the latest statistics from NAR.

Cash buyers in Miami remain undeterred by rising interest rates. The high percentage of cash buyers reflects Miami's position as a top American real estate market for foreign buyers, many of whom prefer to purchase with all cash. Additionally, some buyers are relocating from more expensive U.S. markets and can afford to make cash purchases with the proceeds from real estate sales.

Cash sales accounted for 50.2% of all Miami existing condo sales and 26.4% of single-family transactions.

The graphics are from https://www.miamirealtors.com/